- blurtl

- Posts

- Protecting your cryptocurrency

Protecting your cryptocurrency

While there are a number of problems to watch out for when investing in cryptocurrencies, keeping your money secure is unquestionably a top priority.

For most people, cryptocurrency is still best thought of as electronic cash. But it's more than that: One day, it could be used to buy and sell houses, cars, or even stocks. With this in mind, protecting your cryptocurrency assets is more important than ever. Here are some tips on how to do so:

Get a hardware wallet

If you've decided to invest in cryptocurrency, it's crucial that you take steps to protect your assets. One of the best ways to do this is by using a hardware wallet—a small, offline device that stores all of your cryptocurrency keys. These hardware wallets can be plugged into any computer or smartphone but are not connected to the Internet, so they don't expose your private keys (i.e., the secret passcodes necessary for accessing crypto funds) online. In other words: no hacker can compromise or siphon off your crypto coins if they're locked up tight in a hardware wallet!

The advantages of using a hardware wallet are obvious: They keep your private keys safe from prying eyes, which means hackers won't be able to steal from you even if they manage to hack into some other aspect of your online security system and gain access to other personal information like passwords and email accounts. But there are also some disadvantages worth considering when deciding whether or not this method will work for you—for example, if something happens while using the device itself (e.g., dropping it on concrete), all bets are off; there's no way around this problem without buying new equipment again at great expense!

Get a secure password manager

If you're serious about protecting your cryptocurrency assets, one of the first things you should do is get a secure password manager. This is a program that helps you keep track of strong passwords and login credentials across multiple devices. They're easy to use, and they can even be used on mobile phones—which makes them great for people who travel often or live in areas where internet access isn't always available.

Password managers are also essential because they protect against phishing attacks; if someone tries to trick you into giving out your personal information by pretending to be an official email or platform message, password managers will alert you of this deception by verifying that the message came from the correct source. They'll even let users store their private keys for cryptocurrencies like Bitcoin Cash and Ethereum Classic so that no one else can see them or take control over any digital assets stored in those wallets!

Separate hot and cold wallets

A hot wallet is an electronic device that is connected to the internet. A cold wallet, on the other hand, isn't connected to the internet; it's stored offline and accesses blockchain-related information via a USB drive or other similar method.

When you're using your cryptocurrency assets to pay for goods and services or send/receive money, you may want to keep some of your funds in a hot wallet because they're easier to use than cold wallets (which require more time and effort). However, keeping large amounts of cryptocurrency in a hot wallet increases its vulnerability to hacking or other online attacks. If possible, keep most of your cryptocurrencies in a cold storage device instead of an online one—especially if you plan on holding onto them long-term!

Find a reputable crypto exchange

Look for a reputable crypto exchange.

Find a crypto exchange that is regulated by the government, or at least by a private body that has an interest in making sure the exchange does not break any laws or regulations.

Find a crypto exchange that has a good track record of security. If you have any doubts about their security practices, it could be safer to go with another option instead.

Ask yourself: would I feel comfortable handing over my money and other valuable assets to this company? Do they have good customer support?

Protecting your cryptocurrency assets can be complex, so it's best to be vigilant about every step of the process

In order to protect your cryptocurrency assets, it's essential to understand the risks of keeping them on an exchange. Cryptocurrency exchanges are often hacked, as seen with Mt. Gox and more recently Coincheck. Exchanges have also been shut down for not following regulations or for operating without licenses, such as BitGrail and CoinCheck.

The best way to protect your assets is by keeping them in your own wallet - but if you choose this route, be sure that you have a backup plan in place if something goes wrong with your hardware or software. You can use a hardware wallet like Trezor or Ledger Nano S - these wallets offer full control over keys and even allow users to add additional security measures like multi-signature functionality (whereby multiple keys are required before BTC can be transferred).

It's also important not to keep all of your crypto assets on one machine; spread them out across different devices which might include mobile phones, tablets and laptops/desktops!

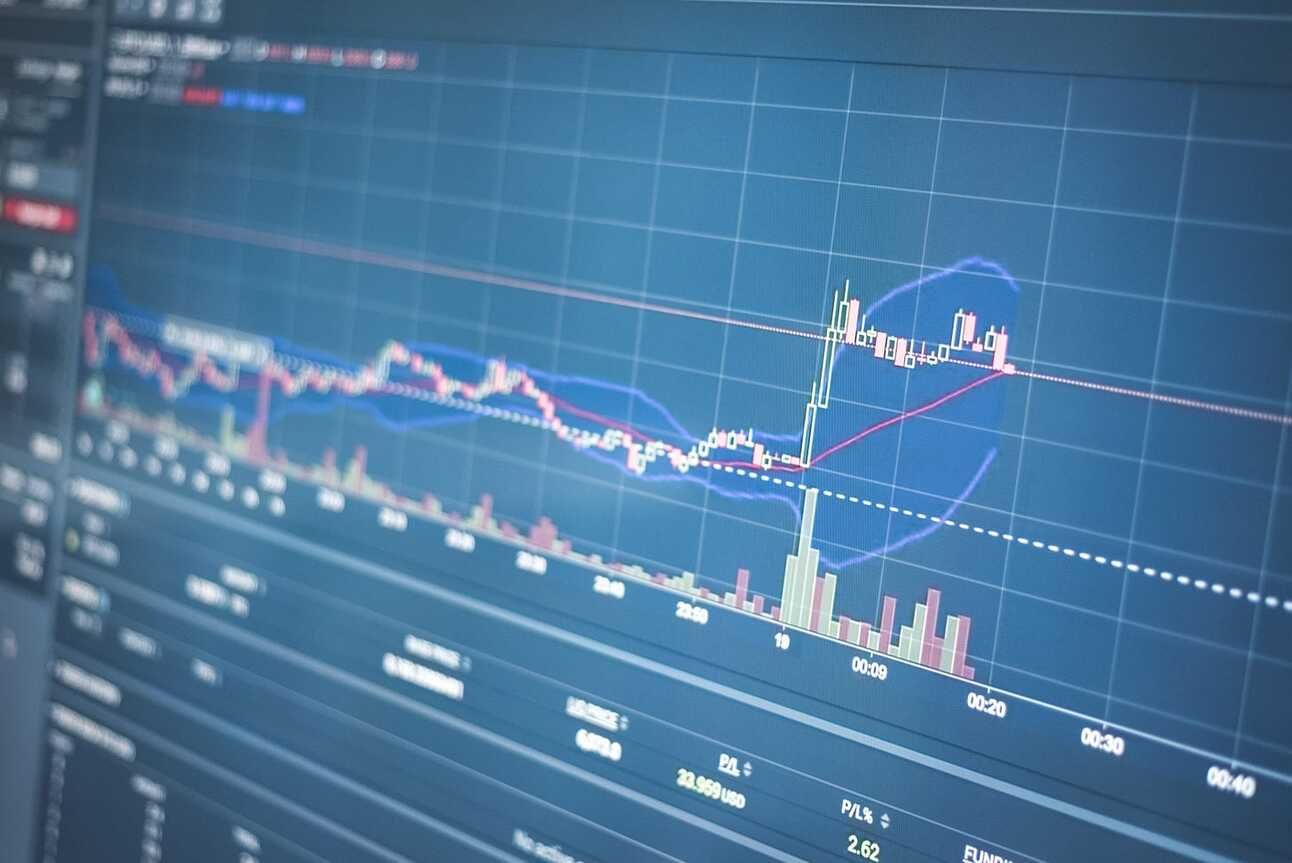

In addition to protecting your cryptocurrency assets, it’s important to make sure that you are not overinvesting in this volatile market. You should consider diversifying your portfolio and keeping an eye on other financial markets as well. Remember: cryptocurrency is still a relatively new technology with lots of room for growth!