- blurtl

- Posts

- Memecoin season is back! And so are we...

Memecoin season is back! And so are we...

Shiba Inu rises 13% in a week - is it memecoin season again? Elon Musk reveals X’s crypto pathway. Tether sell-off, is Huobi solvent? What does the Bitcoin halving mean for you?

GM, and welcome back to the newsletter that some experts have reported is more addicting than crack cocaine!

Some of you have been here since the beginning and the team at blurtl want to extend our deepest thanks for sticking around for the second most anticipated resurrection in the history of mankind.

What’s going on in crypto?

Shiba Inu rises 13% in a week - is it memecoin season again?

$4.5 million ether mysteriously burnt

Elon Musk reveals X’s crypto pathway

Tether sell-off, is Huobi solvent?

What does the Bitcoin halving mean for you?

Is it really memecoin season again?

That’s right people! Roll-up, roll-up! We’re back in the thick of what some speculators are calling “meme season 2.0”.

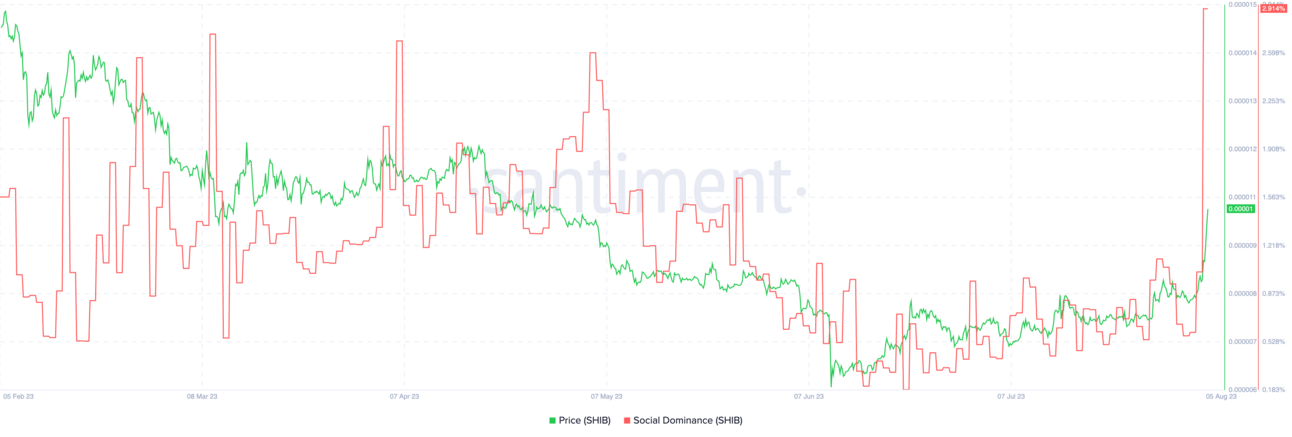

Thanks to certain dog branded cryptocurrencies, the jorts of many punters have been well and truly soiled due to monstrous gains SHIBA has seen this past week. Seeing gains of ~13% last week, it has certainly been a wild ride for investors.

The price has been driven by the team’s announcement of a blockchain-based digital identity system for projects on Shibarium, the L2 scaling solution of Shiba Inu. Bullish on-chain metrics are also responsible for the price, specifically social dominance and trade volume.

Source: Santiment

Why someone threw away $4.5 million worth of ETH

Crypto nerds around the globe were stunned this morning when they caught wind of a transaction made nearly two weeks ago. The transaction gained widespread attention today because an unknown individual sent 2,500 ether (~$4.5 million) to a burn address. This act effectively destroyed the coins, which leaves people questioning the motive of the user only identified by their nd4.eth ENS name.

The guy who transferred 2,500 $ETH($4.58M) to a dead address on July 26th is a whale with 34,287 $GMX($1.84M) and 311,003 $GNS($1.43M).

He spent 5,330 $DAI to buy $GMX and $GNS on July 29 and also transferred 34.9 $GMX ($1,989) and 600 $GNX ($2,733) to the dead address.

— Lookonchain (@lookonchain)

8:56 AM • Aug 7, 2023

On-chain analysts are looking to make sense of the transaction, noting that the unknown individual is also a large holder of tokens from perpetual trading protocols, holding 34,287 GMX tokens (valued at $1.84 million ) and 311,003 Gains tokens worth $1.43 million. The mystery user also sent 1.5 ETH, 34.9 GMX and 600 GNS - worth about $7,000, in total - to the same burning address.

Elon Musk on potential X crypto

Alright, maybe we got a little excited in the rundown for today’s newsletter. It’s not happening. Ever.

Straight from the mouth of the self proclaimed crypto king himself, “I don’t play with that **** bro!”

Let’s be real though, why would he launch his own when he could just buy one and slap a new name on it?

On a serious note, in the wake of many scam tokens being launched with branding similar to Twitter’s new identity, X - Elon Musk asserted that he and X will never launch a crypto token.

That isn’t to say that he can’t implement DOGE into X payment systems as many crypto-thusiasts have speculated over the years.

Why is Tether selling off?

Tether is selling off, and renowned business analyst, Adam Cochran, thinks it could be the result of Huobi being insolvent.

Binance is selling USDT in bulk. Scary? Or are they just loading up their bags for the bull market?

1/16

So why is Tether selling off?

Likely Huobi insolvency.

-Binance started selling off USDT in bulk.

-We found out that Huobi execs (and Tron personnel questioned by police)

-This is not long after Sun's stUSDT launch

-And weird balance shifts at Huobi in the last month— Adam Cochran (adamscochran.eth) (@adamscochran)

10:49 PM • Aug 5, 2023

In a series of tweets, Cochran explains that just like in the case of FTX, Binance is often the first to know when a big dog is about to go under. He also notes that the timing of the selloff coincides with Huobi employees being interviewed by authorities.

Cochran also shared information that Huobi only holds $90 million in USDT and USDC combined. This does not align with the values shown on their “Merkle Tree Audit” which indicated they have $630 million of USDT held.

Bitcoin’s halving and the impact on distinguished investors

Why are you still reading? This section is for distinguished investors only.

Bitcoin’s next halving isn’t expected to occur until April 2024, but it’s somewhat predictable nature introduces a significant amount of volatility in the months leading up to the event.

This process gradually limits the maximum supply of Bitcoin to 21 million BTC. Currently, three halvings have taken place, and the final one is set to occur in 2140. Miners historically see significant impacts after halving events, with the price of Bitcoin usually experiencing notable increases, compensating for reduced rewards.

For holders, Bitcoin halving is attractive as it reduces its inflation rate over time, making it a valuable digital asset. Yet, criticisms exist as some see Bitcoin more as an investment asset rather than a transactional currency due to its design and capped supply. Currently, 90% of the total supply has been mined, leaving only 2.11 million BTC to be mined until 2140.

As the halvings continue to shape the trajectory of this cryptocurrency, miners and holders should be prepared for potential impacts on their operations and investments.

– blurtl