- blurtl

- Posts

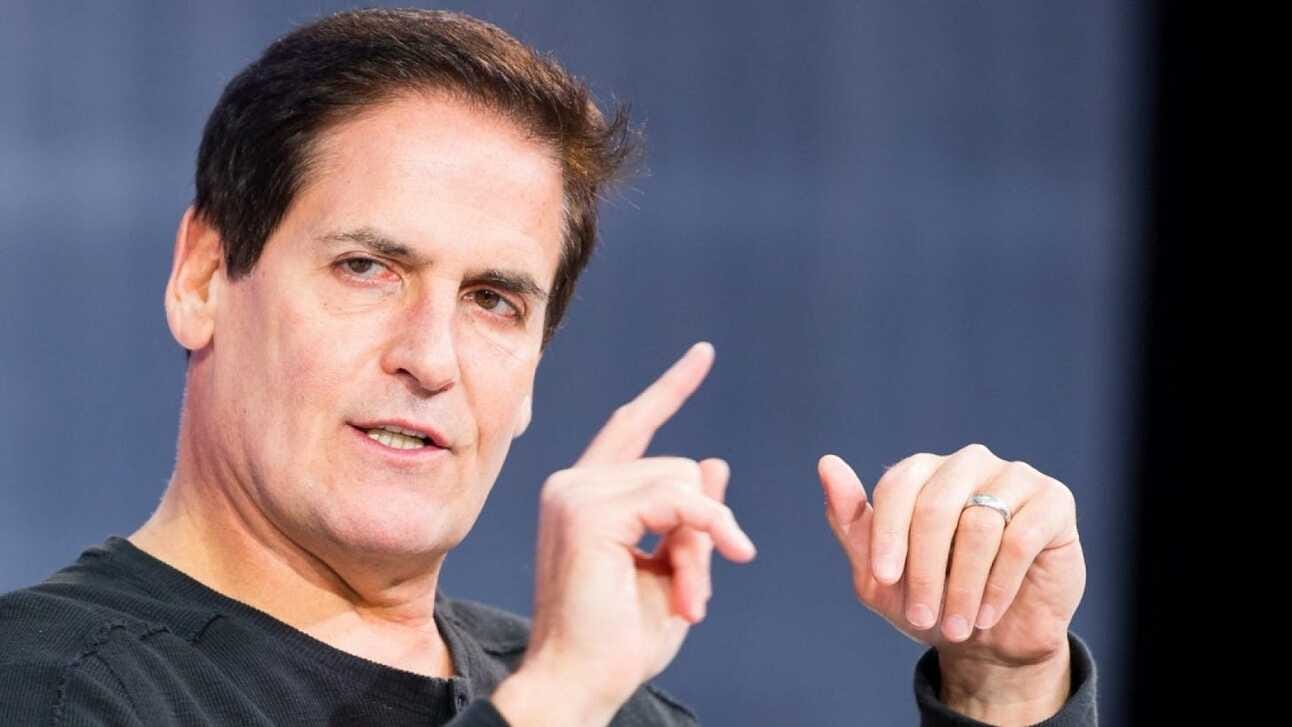

- Mark Cuban warns of 'implosion' in crypto industry due to wash trading

Mark Cuban warns of 'implosion' in crypto industry due to wash trading

Billionaire investor Mark Cuban has warned that the crypto industry could be in for another "implosion" due to the widespread practice of wash trading on centralized exchanges. Wash trading involves buying and selling the same asset in order to create false market information and artificially inflate volumes, with the goal of tricking retail traders into buying and participating in a pump-and-dump scheme. While Cuban does not have specific evidence to back up his prediction, several studies have shown that wash trading is a major problem in the crypto industry.

A report by the National Bureau of Economic Research (NBER) found that up to 70% of volume on unregulated exchanges is wash trading. This means that the majority of trades being reported on these exchanges are not real, but rather are designed to manipulate market information and mislead investors. A study by Forbes reached similar conclusions, finding that more than half of Bitcoin trade volumes on 157 centralized exchanges were fake.

Wash trading is not limited to centralized exchanges and has also been found in the non-fungible token (NFT) market. A report by Quantum Economics and former eToro senior market analyst Mati Greenspan estimates that 42% of NFT volume is wash traded. This is particularly concerning as the NFT market has exploded in popularity over the past year, with many investors pouring money into this new asset class.

In addition to being used to manipulate markets, wash trading is also used to harvest tax losses by making it appear that there has been a greater loss than reality. It is illegal under U.S. law, yet it continues to be a problem due to the lack of transparency and regulation in the crypto industry.

Cuban, who has invested in several crypto and Web3 startups, has also expressed concerns about the tens of millions of dollars in trades and liquidity for tokens with low utilization, which he finds questionable. He predicts that there will be more crypto scandals in 2023, and that the discovery and removal of wash trades on central exchanges will have a significant impact on the industry.

The problem of wash trading can be difficult to detect, as it requires a thorough analysis of trading patterns and behaviors. However, researchers have developed techniques for identifying wash trades using statistical and behavioral patterns. In the NBER report, researchers used these techniques to analyze trading data from various exchanges and found that wash trading is prevalent on unregulated exchanges, but also occurs on regulated exchanges to a lesser extent. The study emphasized the need for greater transparency and regulation in the crypto industry in order to combat the problem of wash trading and protect investors from fraudulent activity.

Overall, the issue of wash trading highlights the importance of due diligence and caution when investing in the crypto market. It is crucial for investors to thoroughly research any exchanges or platforms they are considering using, and to be aware of the potential for manipulation and fraudulent activity in the industry. By being informed and vigilant, investors can protect themselves and make more informed decisions about where to put their money.