- blurtl

- Posts

- Every 184th person globally potentially owns Bitcoin: Adoption on the rise?

Every 184th person globally potentially owns Bitcoin: Adoption on the rise?

Bitcoin is on a winning streak and making attempts to exit the bear market for the first time since the 2020 pandemic period. This is reflected in the latest data which shows that the number of individuals holding the token is also rising. According to data from Finbold, as of January 13, the total number of Bitcoin unique holders stood at 43,540,424, as per CoinMarketCap data. This represents a share of about 0.54% of the global population of 8,010,885,391, meaning that every 184th person globally potentially owns some Bitcoin.

This is an increase from a previous Finbold report in August 2022 which stated that every 226th person globally owned Bitcoin valued between $1 and $99.99. It is important to note that a single individual can own several Bitcoin addresses.

Bitcoin's adoption has been aided by developing countries where the asset offers tangible benefits, such as a possible solution for devalued local currencies. These countries are dominated by significant inflation, with Bitcoin standing out as a likely hedge. For instance, with Bitcoin operating in an environment of high inflation and devaluation of most global currencies, BTC recorded an influx of investors who viewed the asset as a hedge to profit from arbitrage alongside being used for efficient transactions, wealth preservation, e-commerce, and remittances.

The increasing number of Bitcoin holders highlights the state of the cryptocurrency's adoption curve and indicates its progress towards mainstream adoption. This is further highlighted by a previous Finbold report indicating that the asset's blockchain accounted for over $8 trillion in transactions across 2022 despite the depressed markets.

However, the trajectory still faces several obstacles along the way, impacting investor confidence. The crypto market still faces uncertainty in terms of volatility, which may discourage potential investors. Furthermore, regulatory scrutiny remains a significant barrier to fully adopting the asset.

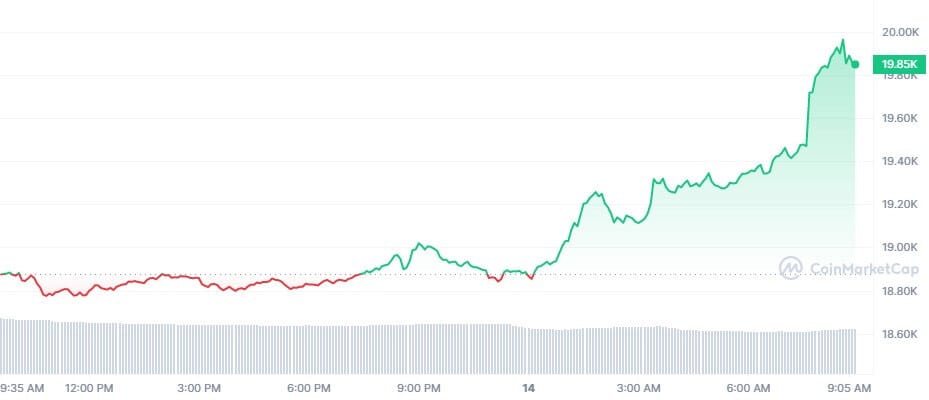

Bitcoin is now targeting the $20,000 position after breaching key support levels. By press time, BTC was trading at $19,956 with daily gains of over 6%. On the weekly chart, Bitcoin is up 18%.