- blurtl

- Posts

- The Daily Blurt - January 18

The Daily Blurt - January 18

Bitcoin price keeps struggling, why Optimism is outperforming Arbitrum, Polygon's 'Delhi Fork' hard fork goes live and Japan's FSA calls for stricter regulations on cryptocurrency industry.

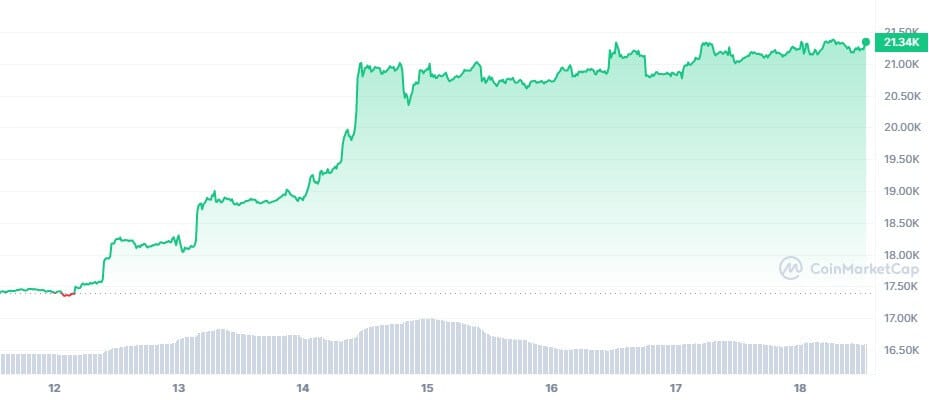

Bitcoin price keeps struggling: Downside correction on the horizon?

Bitcoin is currently facing a major hurdle near the $21,500 zone, as the cryptocurrency struggles to break above this key resistance level. According to data from Kraken, there has been a break below a major bullish trend line with support near $21,100 on the hourly chart of the BTC/USD pair. This suggests that the pair could start a downside correction below the $20,800 and $20,500 support levels.

Despite this, the price is still trading above $20,600 and the 100 hourly simple moving average, and if there is another upside break attempt, an immediate resistance is near the $21,450 level. However, if Bitcoin fails to clear the $21,500 resistance, it could continue to move down, with an immediate support on the downside near the $21,100 zone.

Technical indicators such as the Hourly MACD and Hourly RSI (Relative Strength Index) also support the possibility of a downside correction, with the MACD losing pace in the bullish zone and the RSI for BTC/USD currently near the 50 level. Overall, while the $22,000 level remains a possibility, traders should closely monitor the $20,900 and $20,500 support levels, as a break below these could signal a significant drop in the price of Bitcoin.

Why Optimism is outperforming Arbitrum in Ethereum Layer 2 scaling

Ethereum-based Layer 2 scaling protocols Optimism and Arbitrum have seen a sharp divergence in transaction activity over the past month, with Optimism outpacing Arbitrum since December. Both protocols had been on a steady upward trend since the beginning of 2022, but this is the first time Optimism has significantly outperformed Arbitrum. This is likely due to the increased transactions on Optimism as its token has been one of the top performers across Layer 1 and Layer 2 protocols. Additionally, Arbitrum doesn’t have its own token, and market participants may be looking for new ways to gain exposure to Ethereum as liquid staking derivatives such as Lido and Rocket Pool have also been performing well. Furthermore, The Optimism transaction gains have also occurred as the decentralized perpetual futures exchange GMX, which is built on Arbitrum, saw a 30% drop in use since Dec. 10. Synthetix, a separate perpetual exchange built on Optimism, saw an increase in volume starting around Dec. 20.

Polygon's 'Delhi Fork' hard fork goes live, boosting performance and sparking optimism

The hard fork for Polygon, the Ethereum layer-2 scaling protocol, went live today at block 38,189,056, boosting the performance of the platform and causing a wave of optimism among the MATIC community. The upgrade, called the "Polygon Delhi Fork," aims to reduce gas spikes during transactions and improve transaction finality by reducing chain reorganization. The team behind Polygon noted that the upgrade would change the base fee from 8 to 16, with the goal of smoothing out fluctuations in gas prices. Additionally, the upgrade will reduce sprint lengths from 64 to 16 blocks, allowing for a more seamless experience when interacting with the chain. Since its launch in 2017, Polygon has processed over 2.3 billion transactions and has over 203 million unique addresses signed up, with many decentralized apps building on top of it. The token, MATIC, is expected to continue its ascent towards $2 after a recent surge of 20% in the past week.

Japan's FSA calls for stricter regulations on cryptocurrency industry

The Deputy Director-General of Japan's Financial Services Agency (FSA), Mamoru Yanase, has called on global watchdogs to introduce stricter regulations on the cryptocurrency industry. Yanase believes that digital asset exchanges should be treated in the same way as traditional banks, in order to prevent another collapse of a cryptocurrency platform like that of FTX. He praised the actions of Japan's monetary watchdogs in allowing local FTX users to withdraw funds by mid-February, and argued that global regulators should protect consumers by enforcing more stringent anti-money laundering rules, enhanced governance on the crypto industry, and internal auditing and control. Yanase also suggested that a multi-national resolution mechanism should be established in case of a potential collapse of another giant crypto exchange, with blockchain hubs being the first to introduce the program.

Bear market brings job cuts, but technical and engineering roles remain strong

The crypto market has seen more than 1,600 job cuts in the first two weeks of the new year, as a result of continued market volatility and uncertainty. However, not all departments have been affected equally. According to recruitment professionals, employees in technical and engineering roles, as well as senior management, will likely continue to see “strong demand” for their skills. Rob Paone, founder and CEO of crypto recruitment firm Proof of Talent, said that technical and engineering roles are by a “wide margin” the most in-demand jobs, even during bear markets. He stated that his firm is still seeing “strong demand” for these functions and that salaries are still “very competitive” despite “bidding war type scenarios” no longer being the case for these employees.

Johncy Agregado, director of crypto recruitment firm CapMan Consulting, said that it’s common for mid-level roles to be trimmed during a bear market, but senior functions tend to “double or triple” during a bear market. He added that roles such as chief technology officer and chief information security officer tend to be safe, because people in those positions have to maintain the fluidity of the business and keep “things in order” while the market corrects itself.