- blurtl

- Posts

- The Daily Blurt - January 15

The Daily Blurt - January 15

Avalanche and AWS collaboration could bring blockchain to the masses, CAKE token becomes most traded among top BSC whales, SOL price rises 36% in seven days and SBF denies stealing customer funds.

Avalanche and AWS collaboration could bring blockchain to the masses

Avalanche (AVAX) has partnered with Amazon Web Services (AWS) to bring greater institutional adoption to the cryptocurrency market. As a member of the Amazon Partner Network (APN), Avalanche will now enable APN to help customers deploy customized offerings on AWS connected to over 100,000 partners. Through this collaboration, AWS users will be able to access the Avalanche network and enjoy its benefits such as high scalability, fast confirmation time and low transaction costs. Furthermore, Avalanche will provide AWS customers with a digital asset management platform, allowing them to create and manage custom tokens on their blockchain. This partnership can help companies launch financial solutions such as stablecoins and blockchain-based payment systems.

PancakeSwap's CAKE token becomes most traded among top BSC whales

CAKE, the token associated with the decentralized exchange PancakeSwap, has become the most traded token among the top 100 Binance Smart Chain (BSC) whales. This news comes as CAKE's price has seen a steady increase, with a 10% jump in the last 24 hours and over 17% weekly gains. CoinMarketCap currently values CAKE at $3.87 with a market capitalization of over $651 million. Additionally, CAKE was listed as one of the top Binance Chain projects with the highest bullish sentiments according to a tweet on January 12th. PancakeSwap [CAKE] also revealed new information for bCAKE farmers on January 13th, where farmers can now activate boosters on two farms with an adjusted boost multiplier. The metrics and indicators for CAKE are positive, suggesting that the price pump may continue further.

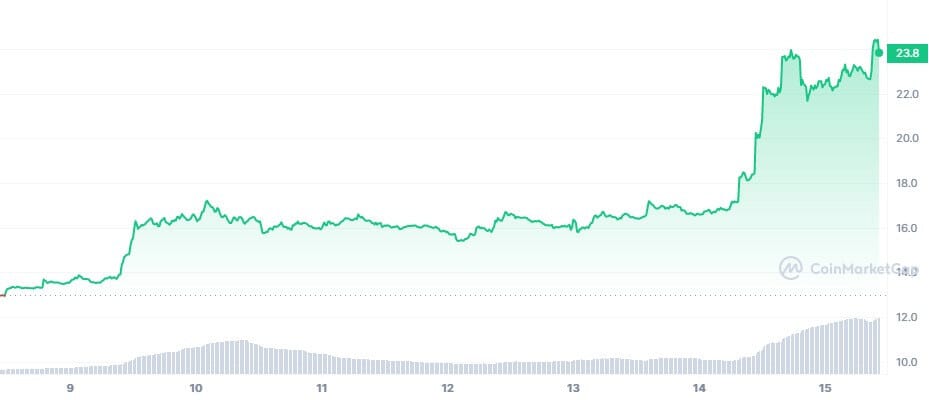

SOL price rises 36% in seven days, flipping Polygon market cap

Solana (SOL) has seen a significant rise in price, with a 36% increase over the last seven days. This has temporarily moved SOL back into the top 10 cryptocurrencies, overtaking Polygon. This is a notable shift in sentiment for the project, as developers leaving Solana had previously caused a bearish outlook. The resurgence in SOL can be attributed to a supportive statement from Vitalik Buterin, the co-founder of Ethereum, on December 29th, 2022. Buterin's tweet on the potential of Solana's developer community and the project's bright future sparked renewed interest in the project, causing SOL's price to more than double in the two weeks leading up to January 14th.

Polygon's zkEVM: The future of Ethereum scaling

The Ethereum layer-2 scaling protocol Polygon is currently testing zero-knowledge rollup (zk-Rollups) technology in a final testnet, ahead of its eventual integration with its mainnet. The development of the technology, called Polygon zkEVM (Ethereum Virtual Machine), has been ongoing for over three years by the Polygon Hermez team. The team has already confirmed that zero-knowledge proofs are possible on Ethereum by generating over 12,000 zk-Proofs in a primary version of the zkEVM testnet. David Schwartz, project lead of Polygon zkEVM and PolygonID, explained that zero-knowledge rollups have increased the speed at which layer-2 platforms can achieve finality while ensuring secure validation of transactions with zero-knowledge technology.

SBF denies improper use of customer funds in bankruptcy pre-mortem

FTX has denied allegations of improper use of customer funds in a "pre-mortem overview" of the company's bankruptcy. The company attributes its fall to the market crash of 2022 and a PR campaign against FTX by Binance CEO Changpeng Zhao. FTX's ex-CEO, Sam Bankman-Fried, claims that a run on the bank turned liquidity issues into insolvency. In recent developments, a group of United States senators criticized one of the law firms involved in the case on the grounds of a conflict of interest, and called on the U.S. Bankruptcy Court for the District of Delaware to appoint an independent examiner into FTX's activities. Additionally, FTX's attorney, Andy Dietderich, announced that the company has recovered $5 billion in cash and liquid cryptocurrencies.

Grayscale claims SEC's denial of Bitcoin ETFs is preventing US investors from gaining exposure

Grayscale, a crypto hedge fund, has told the US Securities and Exchange Commission (SEC) that its denial of Bitcoin exchange-traded funds (ETFs) is "illogical." In a reply to a brief filed by the SEC last month, Grayscale argues that converting its Grayscale Bitcoin Trust (GBTC) into a spot BTC ETF would greatly benefit traders by unlocking value and increasing investor protections. The hedge fund also claims that the SEC's reluctance to further bring Bitcoin into the regulatory perimeter through a spot Bitcoin ETF has prevented US investors from gaining the Bitcoin investment exposure they both want and deserve. Grayscale first sued the SEC in June 2022.