- blurtl

- Posts

- The Daily Blurt - January 11

The Daily Blurt - January 11

Whales purchase 20,000 BTC, Wix.com partners with CoinGate, Crypto.com to delist USDT, Coinbase troubles and USDC sees increased adoption following FTX collapse.

Bitcoin whales drive market recovery with 20,000 BTC purchase

Large investors, known as bitcoin whales, have recently started accumulating more BTC. This comes at a time when the crypto market is seeing struggling prices and low momentum. On-chain aggregator Santiment reports that these large whales, holding between 1,000-10,000 BTC, have added more than 20,000 BTC to their balances over the past five days. This accumulation trend could be a sign of a recovery for bitcoin, as these whales now hold a total of 4.57 million BTC, representing 23.7% of the total circulating supply. This recent accumulation also indicates a long-term strategy and a belief that the price of BTC may have hit its bottom. However, it remains to be seen if this trend will continue and push BTC's price above its 50-day moving average of $17,212.

Wix.com partners with CoinGate to enable crypto payments for European merchants

CoinGate, a leading European crypto payment gateway, announced a new integration with Wix.com, a website building platform, on January 10. This will allow German, Lithuanian, Dutch, and Spanish Wix shop owners to accept crypto payments from their customers. As a result of this partnership, Wix retailers that integrate CoinGate as a payment processor will be able to accept over 70 different cryptocurrencies, including Bitcoin, from their clients. Businesses that receive crypto payments can convert them to a single fiat currency, such as EUR, USD, or GBP and withdraw them. CoinGate's CEO, Justas Paulius, believes that this partnership will inspire more businesses to take advantage of cryptocurrency markets by allowing them to serve a larger number of customers who either only use cryptocurrencies or don't have access to traditional payment methods like banks and credit cards. Despite the crypto market suffering a severe correction in 2022, CoinGate also reported that the volume of crypto payments in eCommerce climbed over 60% in 2022.

Crypto.com announces it will delist USDT in Canada

On January 9th, Crypto.com announced it would delist the popular stablecoin USDT in Canada in order to comply with the country’s regulations. Canadian users were given until January 31st to withdraw or exchange their USDT for other currencies or risk having their USDT automatically convert to Circle’s USDC stablecoin. The decision was made due to regulations prohibiting Canadian customers from trading cryptocurrencies that are considered securities or derivatives. The announcement was met with mixed reactions in the crypto community, with some speculating it could be a sign of what’s to come globally and others calling it a “business deal” to eliminate competition.

Coinbase: Former product manager sentenced to 10 months in prison amidst lay offs of nearly 1000 employees

Nikhil Wahi, the brother of a former Coinbase product manager, has been sentenced to 10 months in prison for insider trading of crypto tokens. Nikhil Wahi pleaded guilty in September to using inside information from his brother Ishan Wahi to trade on at least 14 different occasions, earning him approximately $892,000 in profit. He will also have to return the profits he made from the trades. Ishan Wahi, who was also arrested on insider trading allegations, has pleaded not guilty.

Coinbase, which was previously aware of the suspicions around Ishan Wahi’s activity, announced that it would lay off 950 employees on Tuesday due to the current economic climate. In a blog post, CEO Brian Armstrong explained that this was the best way to reduce operating expenses as the company weathers a downturn in the crypto market.

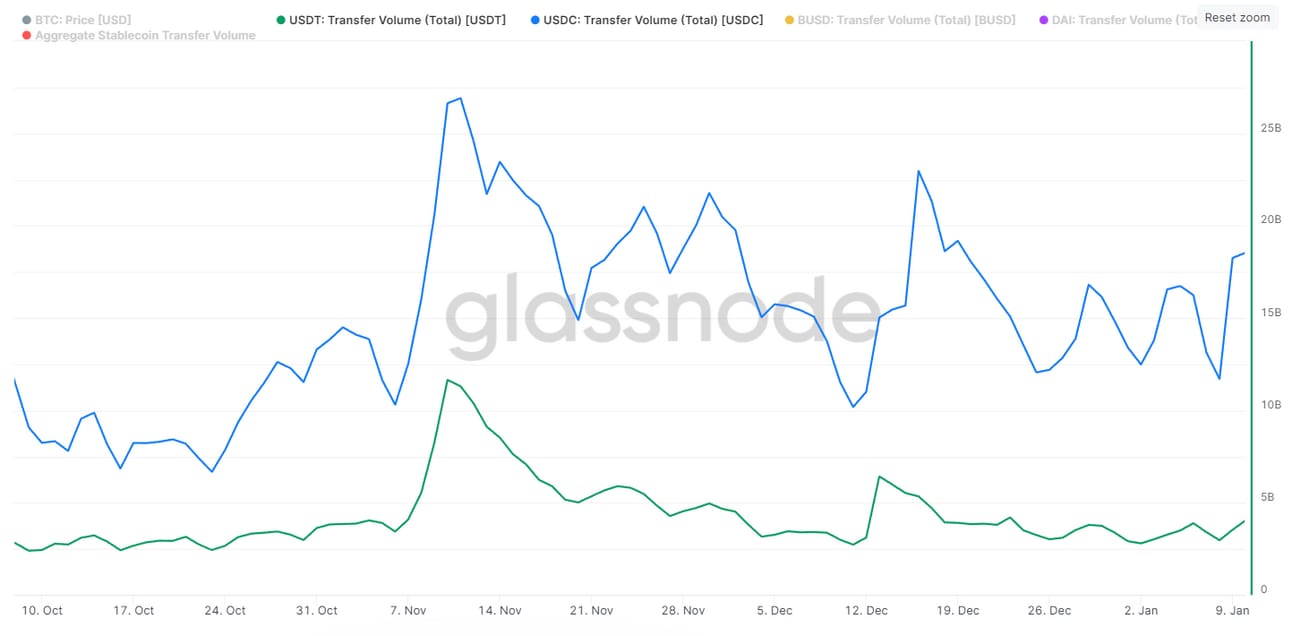

USDC sees increased adoption following FTX collapse

USDC, the stablecoin issued by Circle, has become increasingly popular in comparison to its main rival USDT, with a transfer volume five times greater than its competitor, despite having a smaller market cap. This is according to blockchain analytics firm Glassnode. The increased adoption of USDC is speculated to be a result of the collapse of FTX in November 2022 and the subsequent liquidation of Binance's entire FTT holdings, which made USDC a safer option for crypto users. While both stablecoins are designed to trade as close as possible to $1 and are backed by reserves held by their issuers, USDC is considered a potentially safer option as it has assets backed by cash or short-term US treasuries and it conducts monthly audits by global accounting firm Grant Thornton.