- blurtl

- Posts

- Can $SOL hit $30?

Can $SOL hit $30?

MakerDAO presents a token airdrop idea for the Spark lending protocol. JPMorgan owes the US Government $3,000,000,000 after the banking crisis depletes emergency funds. Binance is requesting registration in Taiwan for AML compliance. Solana (SOL) leads gains among the top coins; is the $30 mark attainable? Over 600 million $ADA locked in, Cardano's DeFi ecosystem passes new milestone.

Well, well, well… What do we have here? Back again for your fix of daily crypto news and analysis are we? Not to worry! We’ve been preparing a fresh hot edition to satisfy your investing needs.

Someone wrote to our inbox the other day and asked what “blurtl” meant?

Urban Dictionary defines it as:

The process of leaving a short recorded outburst, exclamation or message.

Kind of fitting really.

What’s going on in crypto?

MakerDAO presents a token airdrop idea for the Spark lending protocol

JPMorgan owes the US Government $3,000,000,000 after the banking crisis depletes emergency funds

Binance is requesting registration in Taiwan for AML compliance

Solana (SOL) leads gains among the top coins; is the $30 mark attainable?

Over 600 million $ADA locked in, Cardano's DeFi ecosystem passes new milestone

MakerDAO Presents A Token Airdrop Idea For The Spark Lending Protocol

In an effort to encourage long-term engagement with the platform, Rune Christensen, the founder of stablecoin issuer MakerDAO, has proposed creating a new governance token for the Spark lending protocol and distributing them as rewards to users, known as a "pre-farming airdrop." The proposal details the distribution of two billion Spark (SPK) tokens over ten years — a plan to incentivize continued usage of Spark Protocol.

MakerDAO introduced the Spark Protocol, a lending protocol that offers DeFi loans by obtaining liquidity directly from Maker. It accepts collateral in the form of ether, staked ether, and Dai.

The emergence of Spark Protocol as a potential competitor to Aave, which has $4.6 billion in total value locked (TVL), follows Aave's decision to introduce its own yield-generating stablecoin dubbed GHO last year. The new protocol will be reinforced by pricing oracles, or data sources, provided by Chronicle Labs and Chainlink to enhance security in case one of the two goes down or suffers an exploit.

JPMorgan Owes the US Government $3,000,000,000 After the Banking Crisis Depletes Emergency Funds

The largest banks in the United States are preparing to pay the Federal Deposit Insurance Corporation billions of dollars to replenish an insurance fund that is supporting the system.

Reuters reports that a total of $8.2 billion will be paid by JPMorgan, Wells Fargo, Bank of America, Goldman Sachs, Morgan Stanley, PNC Financial Services Group, and Citigroup to restore the emergency fund.

The fees are part of the FDIC's "special assessment" implementation, which it proposed in May, where the costs of protecting depositors are paid for by payments from large financial institutions. JPMorgan will pay a total of $3 billion, by far the largest amount of any of the banks.

Binance Is Requesting Registration In Taiwan For AML Compliance

The biggest cryptocurrency exchange in the world, Binance, has submitted an application to be registered under Taiwan's Money Laundering Control Act, which is currently the only crypto-related legislation the country's government has created.

The Financial Supervisory Commission (FSC) of Taiwan informed the dozens of domestic cryptocurrency service providers present at the meeting that Binance is requesting to be registered for anti-money laundering compliance.

Since the FSC implemented anti-money laundering regulations in July 2021, Taiwan has required virtual assets services providers (VASPs) to abide by its anti-money laundering laws. Otherwise, the sector is still largely unregulated in the nation.

Solana ($SOL) Leads Gains Among The Top Coins; Is The $30 Mark Attainable?

Similar to many other cryptocurrencies on the market, the price of Solana ($SOL) has been wildly erratic over the last week. $SOL is currently trading above $24 and has increased in price by 8.01% over the last week.

In terms of its total value locked (TVL), Solana has experienced significant growth. Solana performed better than other chains last month, according to data from Messari, with a 14% increase in the amount of funds locked in.

Increased Total Value Locked (TVL) for Solana may encourage more people to purchase SOL tokens. Importantly, as interest grows, there may be greater demand for Solana's tokens, which could drive up the price.

Even with a rising TVL, however, if there is unexpectedly bad news regarding Solana's security or performance, people may become concerned and begin selling their $SOL tokens. The price could fall as a result of the decreased demand and increased supply.

Over 600 million $ADA locked in, Cardano's DeFi ecosystem passes new milestone

The total value locked on the Cardano decentralized finance (DeFi) ecosystem recently passed the 600 million $ADA milestone, with the amount of the network's native tokens locked on DeFi applications having increased threefold since the year's beginning.

Cardano's total locked value, expressed in U.S. dollars, has increased from about $49 million at the start of the year to close to $180 million, according to data from DeFiLlama, a DeFi tracking and analytics service. However, the ADA was briefly above 600 million tokens and is now very close to that number after a brief drop.

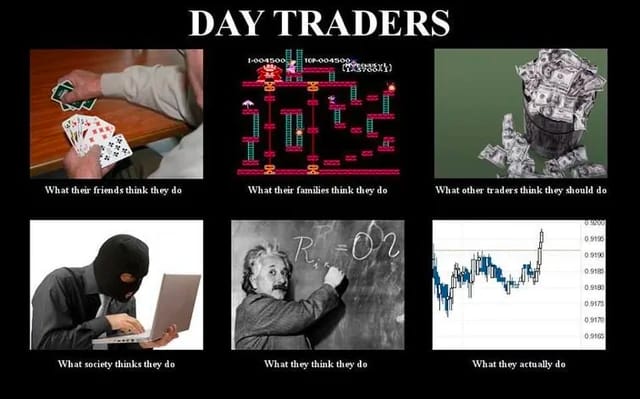

Meme Of The Day (MOTD)

Stay safe out there gang, and keep stacking those sats!

– blurtl