- blurtl

- Posts

- Bitcoin search interest in US skyrockets by 500%

Bitcoin search interest in US skyrockets by 500%

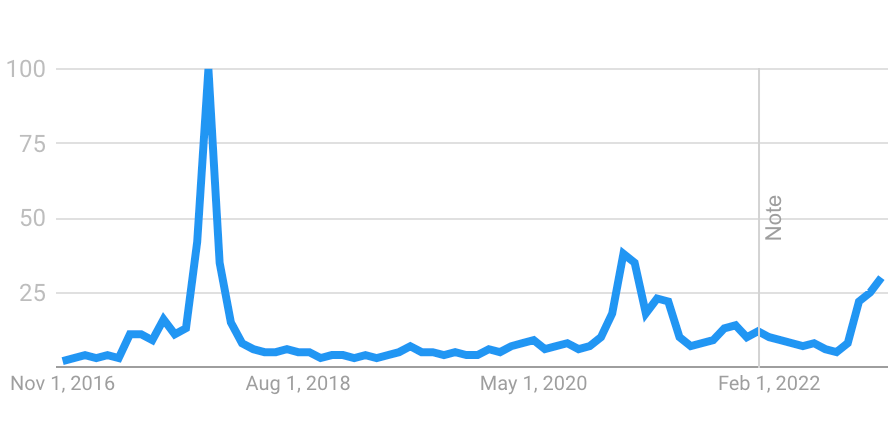

There has been a significant increase in search interest for "how to buy bitcoin" in the United States over the past few months. According to data, searches for this term have increased by 500% since August. This trend appears to be concentrated in certain cities, with the top five cities for search interest being Honolulu, Hawaii; Anchorage, Alaska; Lafayette, Indiana; Odessa/Midland, Texas; and Miami, Florida.

The current price of bitcoin is around $16,600, which represents a slight decrease of 0.26% in the past 24 hours. While bitcoin has struggled to regain momentum, it has remained at the $16,000 price level for some time. As a result, bitcoin volatility has fallen to historical lows, and it is expected that the last two days of the year will follow this trend.

It is important for bitcoin to hold above the $16,000 mark to close out the year, as a finish below this level would be considered bearish and could trigger further declines in the market. Currently, bitcoin investor sentiment has reached a standstill due to the struggling prices in the market.

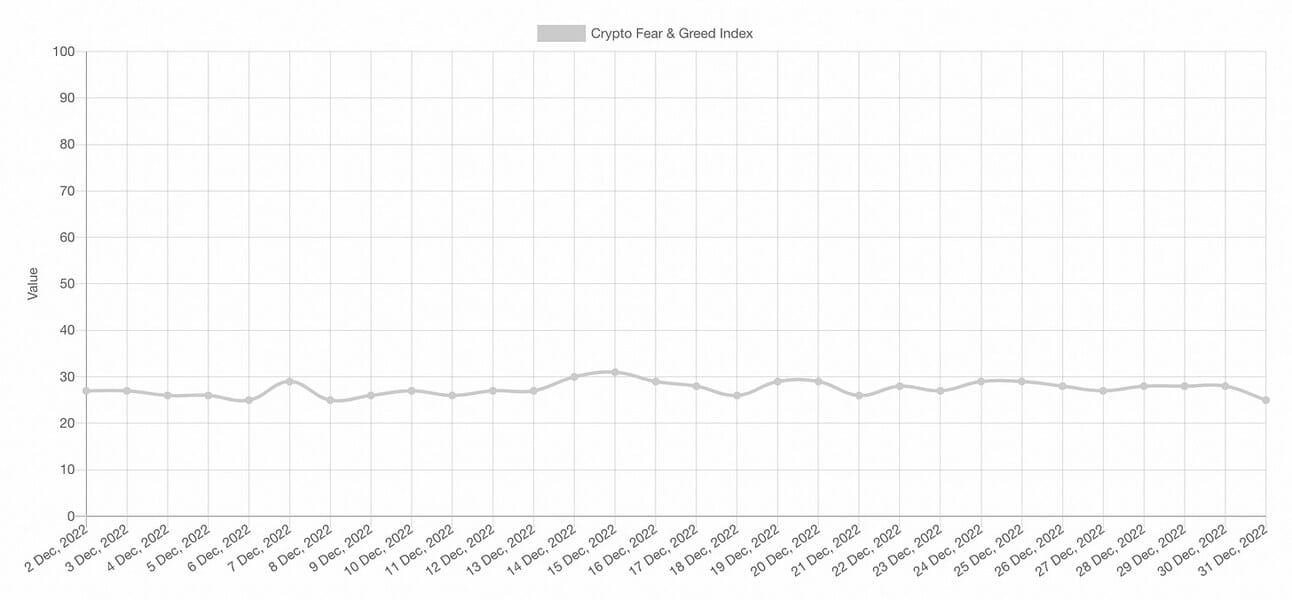

According to the crypto Fear & Greed Index, bitcoin investor sentiment has remained in the fear territory for the past month. This index measures investor sentiment in the bitcoin market on a scale of 0-100, with 0 representing extreme fear and 100 representing extreme greed. A score between 0-25 indicates that the market is in the fear territory, while a score between 76-100 indicates that the market is in the greed territory.

Over the past month, the index has consistently scored between 26-30, indicating that investors are not willing to take any risks in the bitcoin market. Sell sentiment has not been as strong as expected, as the index has not decreased significantly. This indicates that hold sentiment currently dominates the market, with investors choosing to hold onto their coins rather than sell them.

It is clear that there is currently a high level of caution among bitcoin investors, as evidenced by the consistent score in the fear territory on the Fear & Greed Index. While it remains to be seen how the market will progress in the coming days, it is important for bitcoin to hold above the $16,000 mark to avoid bearishness and further declines.