- blurtl

- Posts

- Asia's Bitcoin supply reaches ATH

Asia's Bitcoin supply reaches ATH

According to on-chain metrics, Asia accounts for 7.3% of all Bitcoin supply worldwide.

Asia

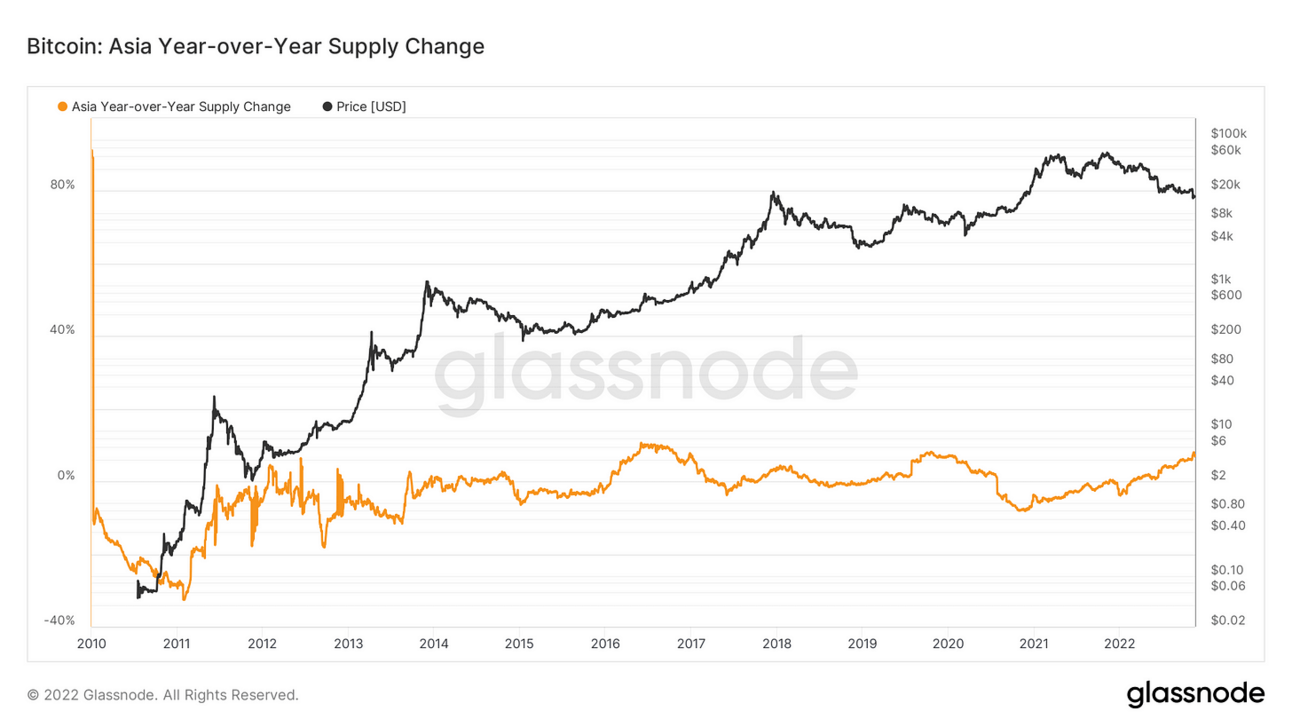

Bitcoin supply in Asia has reached its all-time high and currently accounts for 7.3% of all Bitcoin supply, while the U.S. and E.U. Bitcoin reserves are in negative year-over-year supply.

Data shows that while Asia has been accumulating Bitcoin, the EU and the U.S. have both seen their supply levels depleted.

EU

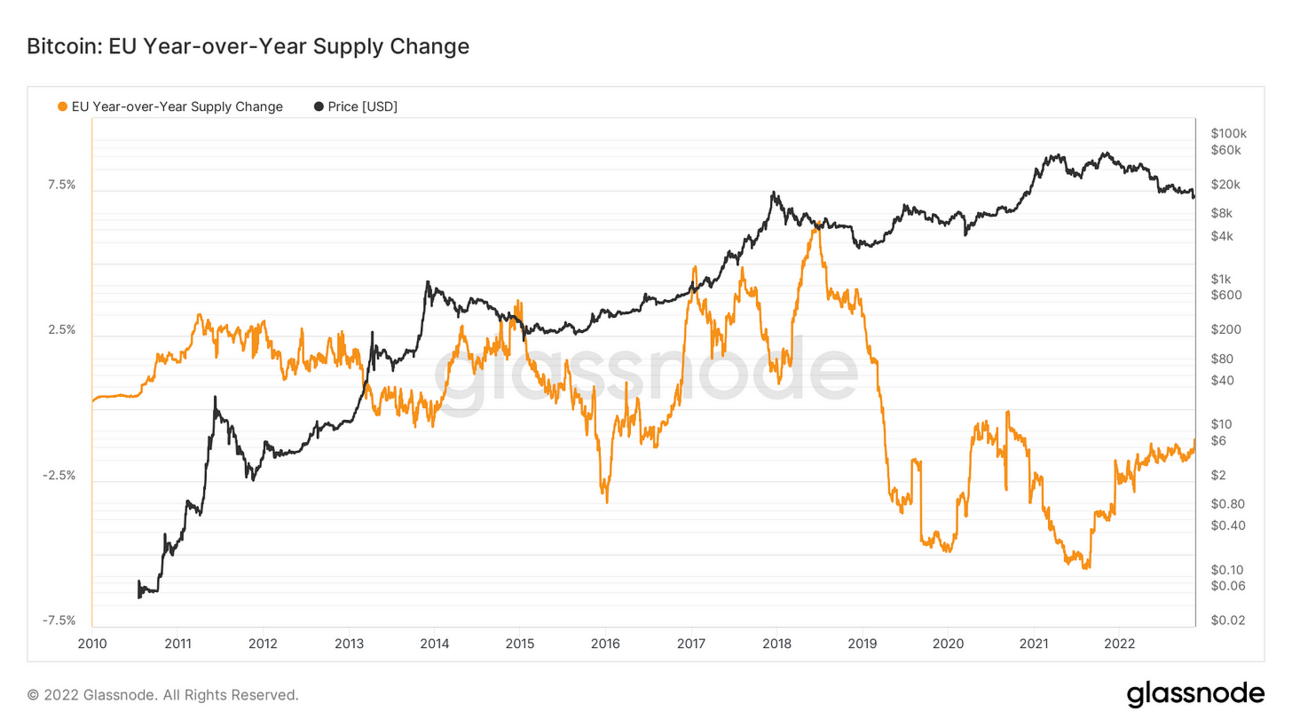

The below chart shows the fluctuations of EU’s Bitcoin supply since 2010. It is shown the region has also experienced below-zero supply levels like Asia, although it did relatively better until late 2019.

EU’s Bitcoin supply level recorded its all-time-high in late 2018, at the time the reserve accounted for nearly 6.25% of the world’s total supply. Data also shows that this percentage fell to negative 2.5% in mid-2019 and negative 5% in 2020.

EU reserves managed to recover to zero in mid-2020 before plummeting back to negative 5% by mid-2021. Currently, their reserves are on a recovery trajectory but still remain at approximately negative 1.25%.

US

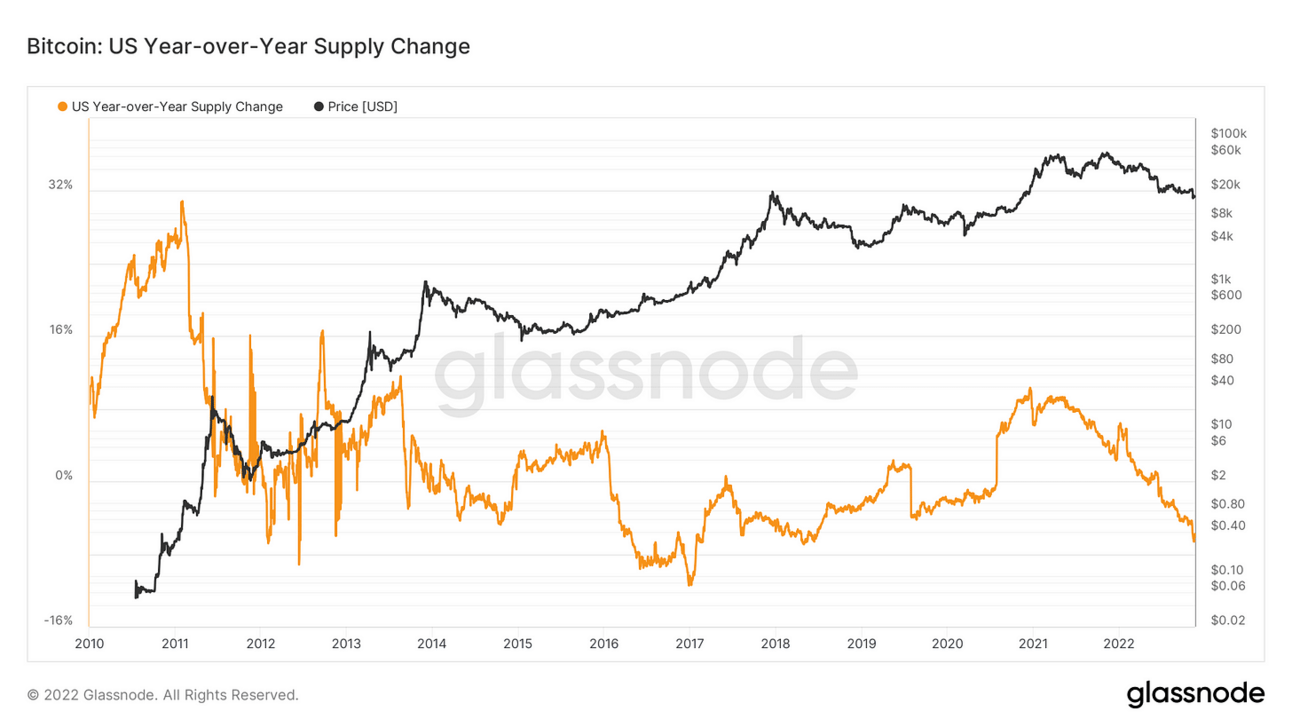

As you can also see from the chart below, US Bitcoin supply levels were above zero for the most of the time between 2010 and 2016.

After falling below zero in early 2016, their reserves struggled to increase to the positive side until late 2020. Even after recovering above zero in 2021, the US Bitcoin supply remains to shrink.

US Bitcoin supply had it’s all-time-high in 2011, where it accounted for nearly 30% of global supply. The US failed to maintain the positive supply level it re-established in 2021, and again, fell below zero earlier this year. At the time of writing, US Bitcoin supply accounts for about 8% of global supply.

Asia’s crypto future

Crypto adoption in Asia is widespread and unprecedented in comparison to many parts of the western world. According to HSBC and KPMG, of 6472 start-ups in the Asia region, approximately a quarter are crypto-related. Major countries in the region like Japan are spearheading widespread adoption, bringing innovation and manpower to the industry.

Ways in which mass-adoption is being fast tracked in Japan is through decisions surrounding regulations. Softening regulatory laws and reducing tax burdens are two ways in which lawmakers are speeding up adoption.

A stark contrast can be seen in China where all cryptocurrencies are banned although many speculate that we could see a reversal of this law in the future as crypto becomes more widespread. If the rest of the world integrates crypto with their regular financial systems then China may not have a choice in the matter.

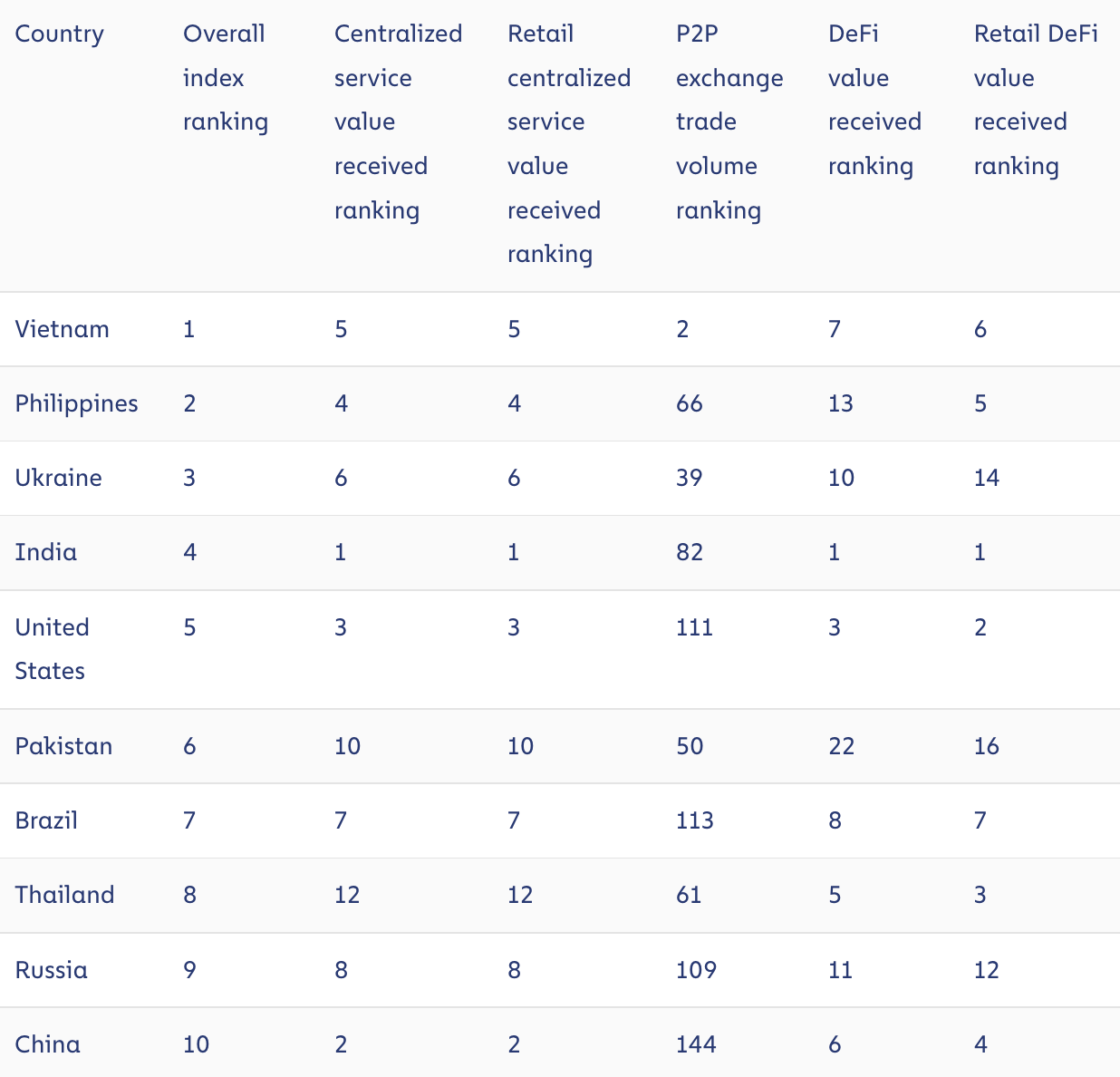

According to a report by Chainalysis, Vietnam, Philippines, India, Pakistan and China were all ranked in the top ten of ”The 2022 Global Crypto Adoption Index Top 20”. The most notable in this list are definitely Vietnam and Philippines who are leading the pack, although this is the second year Vietnam has taken out the top spot.